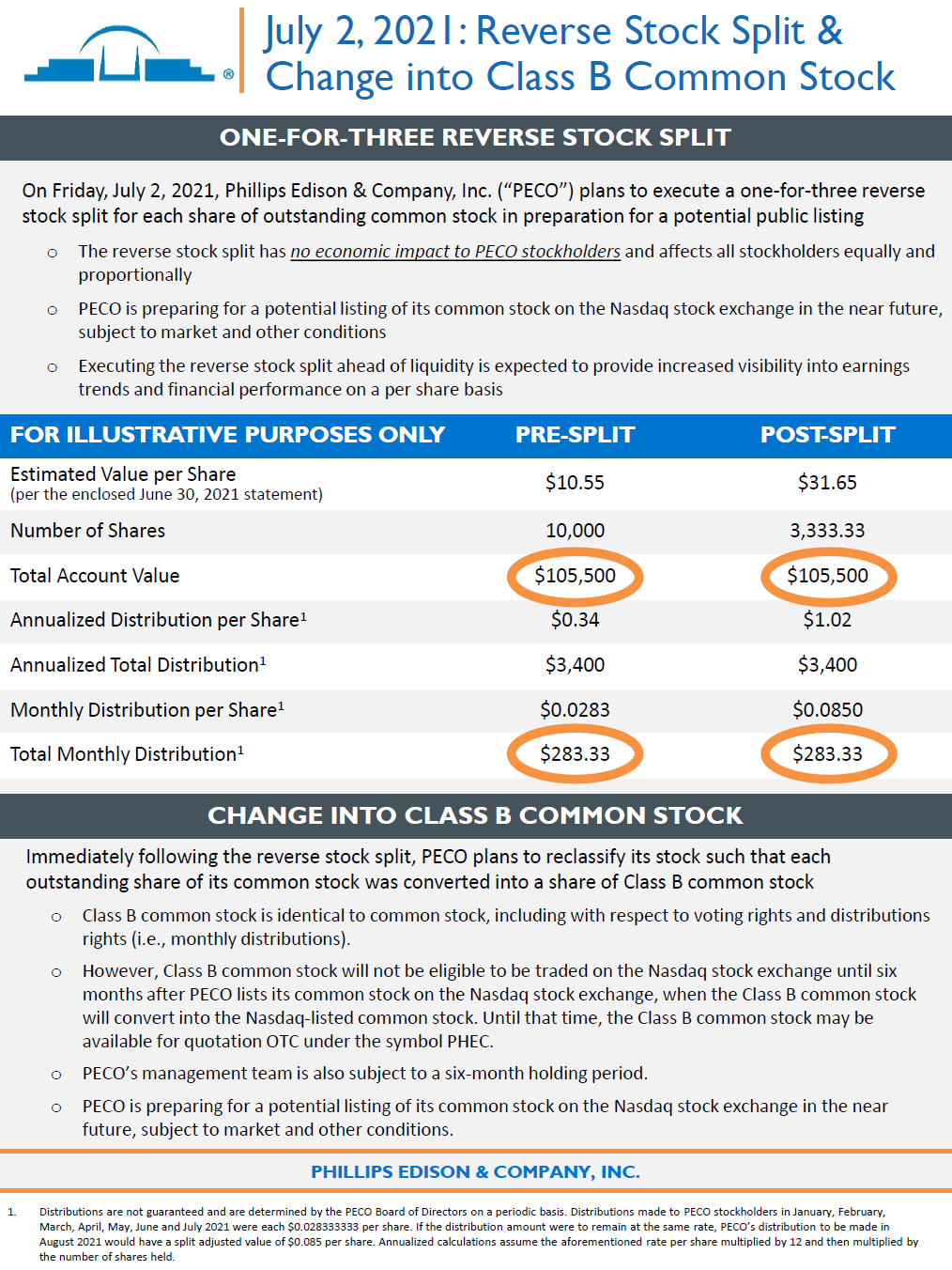

One-For-Three Reverse Stock Split

On July 2, 2021, Phillips Edison & Company, Inc. (“PECO”) executed a one-for-three reverse stock split of each issued and outstanding share of PECO’s common stock, $0.01 par value (the “Common Stock”), and a reclassification transaction in which each issued and outstanding share of Common Stock (following the reverse stock split) changed into a share of PECO’s newly created Class B common stock, $0.01 par value (the “Class B Common Stock”).

PECO’s stockholders previously approved the reclassification transaction on June 18, 2021, and PECO’s board of directors (the “Board”) approved the reverse stock split on June 14, 2021. As a result of the reverse stock split and reclassification transaction, PECO’s stockholders received one share of post-split Class B Common Stock for every three shares of pre-split Common Stock they held.

The Class B Common Stock is identical to the Common Stock, including with respect to voting rights and distributions rights (i.e., monthly distributions), except that upon the six-month anniversary of the potential listing of PECO’s Common Stock on a national securities exchange, or such earlier date or dates as approved by the Board (subject to certain limitations), each share of the Class B Common Stock will automatically convert into one share of listed Common Stock.

Although the reverse stock split reduced PECO’s total shares of Common Stock outstanding, it had no economic impact to PECO’s stockholders, as all were impacted equally and proportionally. PECO’s business remains unchanged following its reverse stock split and the reclassification transaction.

PECO’s stockholders previously approved the reclassification transaction on June 18, 2021, and PECO’s board of directors (the “Board”) approved the reverse stock split on June 14, 2021. As a result of the reverse stock split and reclassification transaction, PECO’s stockholders received one share of post-split Class B Common Stock for every three shares of pre-split Common Stock they held.

The Class B Common Stock is identical to the Common Stock, including with respect to voting rights and distributions rights (i.e., monthly distributions), except that upon the six-month anniversary of the potential listing of PECO’s Common Stock on a national securities exchange, or such earlier date or dates as approved by the Board (subject to certain limitations), each share of the Class B Common Stock will automatically convert into one share of listed Common Stock.

Although the reverse stock split reduced PECO’s total shares of Common Stock outstanding, it had no economic impact to PECO’s stockholders, as all were impacted equally and proportionally. PECO’s business remains unchanged following its reverse stock split and the reclassification transaction.

Stockholders will receive more details with their June 30, 2021 statement and will receive a statement thereafter that reflects the reverse split. Questions? Please reach out to our Investor Relations department at (833) 347-5717.